Hidden Costs When Buying a Home in Toronto in 2024

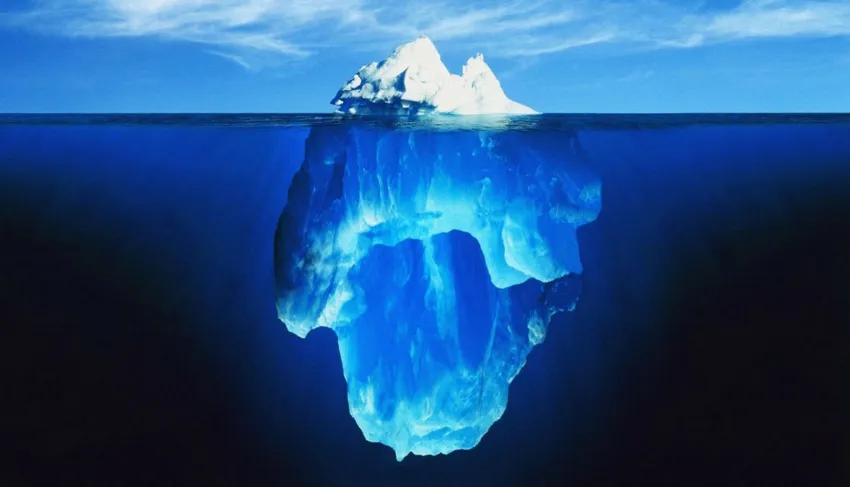

Buying a home in Toronto? Be prepared for some hidden costs that can catch you off guard. Here's a rundown of what you might encounter:

Real Estate Fees

Usually, the seller covers real estate fees, but in some rare cases, the buyer might have to pay. It's not common, but it's good to be aware.

Land Transfer Tax

In Toronto, there's a significant land transfer tax, and on top of that, an extra municipal tax. This can add a hefty amount to your closing costs.

Home Inspection

A home inspection is crucial to avoid unpleasant surprises later. Expect to pay between $300 to $500 for this service.

Appraisal Fee

Your lender might require an appraisal of the property, which usually costs around $300 to $500. This ensures the home's value aligns with the loan amount.

Legal Fees

Legal assistance is necessary for handling all the paperwork, and legal fees can range from $1,500 to $2,500. This covers everything from title searches to closing the deal.

Title Insurance

Title insurance protects you against potential issues with the title of your new home. This typically costs between $250 to $400.

Mortgage Insurance

If your down payment is less than 20%, you'll need mortgage insurance, which can vary in cost depending on the size of your mortgage and the loan-to-value ratio.

Property Insurance

Don't forget to budget for property insurance, which generally costs around $800 to $1,200 per year. This protects your investment against damages or loss.

Moving Costs

Moving all your belongings isn't cheap. Depending on how much stuff you have and the distance you're moving, costs can range from a few hundred to several thousand dollars.

Utility Hookups

Connecting utilities might come with some fees, and you might also need to cover any prepaid bills from the previous owner.

Maintenance and Repairs

Owning a home means being prepared for maintenance and repair costs. It's wise to set aside some money regularly for these inevitable expenses.

Conclusion

Being aware of these hidden costs can help you plan better and avoid surprises during the home-buying process. If you have any questions or need further assistance, feel free to reach out. Good luck with your home search!